Client: Investment management firm

Users: Investment analysts, portfolio managers

Computation, storage, and display of proprietary analytics for a volatility-based portfolio management methodology.

Computation sub-system for screening securities implemented via an Excel add-in with an MSForms UI:

- Retrieves price data from the web, loads the function library, populates a calculation template, and computes the metrics for each security in the universe.

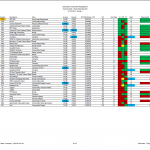

- Accumulates current values and filters and ranks the securities in custom groups.

- Generates data in various formats (xlsx, csv, pdf) for presentation or downstream processing.

- Daily output is the foundation of a live strategy with $250 million in assets under management.

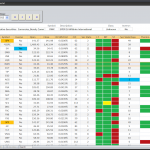

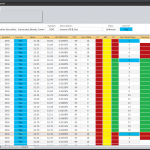

Storage sub-system is a time-series database which stores price data, pre-computed metrics, and custom attributes for a universe of ETF’s:

- Provides historical and cross-section views of the data in a color-coded scheme.

- Enables the analyst to filter and sort the data through an intuitive GUI.

- Serves as the primary source of input to the testing process for rule-driven trading models.

- Computation – Main

- Computation – Progress

- Computation – Final

- Computation – Output

- Storage – Trading Day View

- Storage – Security View